Formula of Days Payable Outstanding Calculation (Table of Contents)

What is Days Payable Outstanding (DPO)Formula?

The term “Days Payable Outstanding” refers to the average time taken by an organization/entity to repay its creditors or suppliers. To put it simply, the average time in which an entity pay-off it’s a business day to day liabilities is Days Payable Outstanding and is mostly used by entities or companies to study the impact on change in working capital requirements. In this article, we will focus on the formula for Days Payable Outstanding which is expressed as accounts payable multiplied by 90/365 days divided by Cost of Goods Sold (COGS)

The DPO is generally calculated for two periods –

- DPO on a quarterly basis, useful where the involvement of working capital is high.

- DPO on a yearly basis, useful where the involvement of working capital is low or moderate.

Mathematically, Days Payable Outstanding is represented as:

The number of days maybe 90 or 365 days depends on the interval for which we are calculating our DPO and the COGS is calculated by subtracting the closing inventories from the sum total of opening inventories and purchases made during the year. Mathematically, it is represented as:

Explanation of Days Payable Outstanding Formula

The formula for days payable outstanding can be derived by using the following steps:

Step 1: Firstly, determine the Accounts Payable (A.P.) for the selected period, which is the difference of total purchases minus cash purchases i.e. purchases made on credit.

Step 2: Finally, the formula for Days Payable Outstanding (DPO) is expressed as AP multiply by period for which the DPO is calculated divided by COGS.

Examples of Days Payable Outstanding Formula (with Excel Template)

Let’s see some simple to advanced examples of days payable outstanding formula to understand it better.

Days Payable Outstanding Example #1

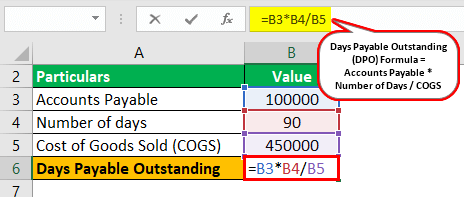

Let us take the example of a company whose accounts payable for the quarter are $100,000 and the cost of goods sold for a similar period is $450,000, then for calculation of Days payable outstanding the following steps are to be taken.

Solution:

Use the given data for the calculation of days payable outstanding.

Calculation of days payable outstanding can be done as follows:

Now, Days Payable Outstanding (DPO) for the quarter can be calculated by using the above formula as,

Days Payable Outstanding = $100000 * 90 days / $450000

Days Payable Outstanding will be –

Days Payable Outstanding = 20 days

Days Payable Outstanding Example #2

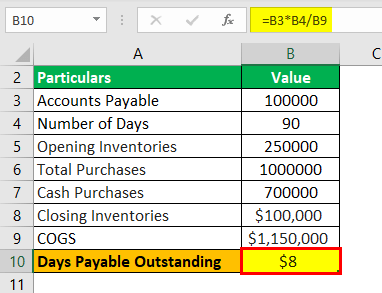

Let us take the example of a company whose accounts payable for the quarter are $100,000. The value of inventories at the beginning of the quarter is $250,000 total purchases made during quarter $1,000,000 out of which cash purchases are of $700,000 and inventories of $100,000 remain unsold at the end of the quarter. Then for the calculation of Days payable outstanding for the quarter the following steps are to be taken.

Solution:

Use the given data for the calculation of days payable outstanding.

Now, First we have to start with the calculation of the cost of goods sold (COGS) by using the following formula:

COGS = 250,000 + 1,000,000 – 100,000

COGS = $ 1,150,000

Now, Days Payable Outstanding (DPO) for the quarter can be calculated by using the above formula as,

Days Payable Outstanding = $100,000 * 90 days / $1,150,000

Days Payable Outstanding will be –

Days Payable Outstanding = 8 days (Approximately)

Note:

It must be noted that while calculating COGS in the given example cash purchase is not considered as to whether the purchase is made in cash or on credit it must be included while calculating COGS.

Days Payable Outstanding Example #3

Let us take another example where the company whose accounts payable for the quarter April to June are $100,000 and for the quarter July to September are $500,000 and the cost of goods sold for the quarter April to June is $450,000 and for the quarter July to September is $500,000, then for calculation of days payable outstanding the following steps are to be taken.

Solution:

Given Data for Quarter April to June:

Now, Days Payable Outstanding (DPO) for the quarter can be calculated by using the above formula as,

Days Payable Outstanding = $100000 * 90 days / $450000

Days Payable Outstanding will be –

Days Payable Outstanding = 20 days.

Similarly,

Given Data for Quarter July to September:

Now, Days Payable Outstanding (DPO) for the quarter can be calculated by using the above formula as,

Days Payable Outstanding = $500000 * 90 days / $500000

Days Payable Outstanding will be –

Days Payable Outstanding = 90 days

Therefore, from the above-given example, it is amply clear that in the period April to June the company is paying its creditors in 20 days but in period July to September, the company has increased its days payable outstanding to 90 days.

Days Payable Outstanding Formula Calculator

You can use these days payable outstanding formula calculator.

| Accounts Payable | |

| Number of Days | |

| COGS | |

| Days Payable Outstanding (DPO) Formula | |

| Days Payable Outstanding (DPO) Formula |

| |||||||||

|

Relevance and Uses

It is an important concept from an economic point of view because it allows the company to manage its working capital easily. The funds which are available because of this DPO technique may also be invested in short term investments. While fixing the Days payable outstanding by a company, certain factors must be kept in mind such as industry average Days payable outstanding and the industry in which the company is working.

Recommended Articles

This has been a guide to days payable outstanding formula. Here we discuss the calculation of days payable outstanding(DPO) using its formula along with examples and downloadable excel template. You can learn more about financial analysis from the following articles –

- Accounts Payable Cycle Meaning

- Days Sales Outstanding Calculation

- Days Inventory Outstanding Calculation

- Cost of Revenue Calculation

The post Days Payable Outstanding Formula appeared first on Wallstreet Mojo.