Financial Statement Analysis

- Turnover Ratios

- Inventory Turnover Ratio

- Inventory Ratio

- Accounts Receivable Turnover

- Accounts Receivables Turnover Ratio

- Accounts Payable Turnover Ratio

- Days Inventory Outstanding

- Days in Inventory

- Days Sales Outstanding

- Days Sales Uncollected

- Average Collection Period

- Days Payable Outstanding

- Cash Conversion Cycle

- Cash Conversion Cycle (CCC) Formula

- Activity Ratios

- Fixed Asset Turnover Ratio Formula

- Debtor Days Formula

- Working Capital Turnover Ratio

- Ratio Analysis (17+)

- Liquidity Ratios (29+)

- Profitability Ratios (66+)

- Efficiency Ratios (7+)

- Dividend Ratios (9+)

- Debt Ratios (26+)

Related Courses

Debtor Days Formula is used for calculating the average days required for receiving the payments from the customers against the invoices issued and it is calculated by dividing trade receivable by the annual credit sales and then multiplying the resultant with a total number of days.

Debtor Days Formula (Table of Contents)

What is Debtor Days Formula?

The term “debtor days” refers to the number of days that a company takes to collect cash from its credit sales which is indicative of the company’s liquidity position and its collections department’s efficiency. It is also known as days sales outstanding (DSO) or receivable days. The debtor days ratio calculation is done by dividing the average accounts receivable by the annual total sales and multiplied by 365 days.

Receivable Days Formula can also be expressed as average accounts receivable by average daily sales.

Receivable Days Formula is represented as,

Debtor Days Ratio = (Average accounts receivable / Average daily sales)

Explanation of the Debtor Days Formula

The debtor days formula calculation is done by using the following steps:

Step 1: Firstly, determine the average accounts receivable of the company. The average accounts receivable is computed by adding the receivable amount at the beginning of the year with that of the end of the year and then dividing the result by two. Both information can be collected from the balance sheet of the company.

Average accounts receivable = (Opening accounts receivable + Closing accounts receivable) / 2

Step 2: Next, determine the total annual sales of the company which is easily available as a line item in the income statement of the company. Further, the average daily sales can also be calculated by dividing the annual total sales by 365 days (number of days in a year).

Average daily sales = Annual total sales / 365

Step 3: Finally, the debtor days ratio calculation is done by dividing the average accounts receivable by the total annual sales and then multiply by 365 days. Receivable Days Formula can also be calculated by dividing the average accounts receivable by the average daily sales.

Debtor days formula = (Average accounts receivable / Annual total sales) * 365 days

or

Debtor days Ratio Calculation = (Average accounts receivable / Average daily sales)

Examples of Debtor Days Formula (with Excel Template)

Lets see some simple to advanced examples of Debtor Days Calculation to understand it better.

Debtor Days Formula – Example#1

Let us take the example of David who is a garment retailer and often offers credit to his customers. David is known for selling to customers on credit with the expectation that these customers would pay back for the merchandise within the next 30 days. Although most of the customers pay for their goods promptly, there are some who are late. Calculate the debtor days ratio considering that at the end of the financial year the statements recorded the following accounts:

Given,

- Average Accounts Receivable: $30,000

- Annual total sales: $210,000

Below is given data for calculation of Days Sales Outstanding

Therefore, Debtor Days can be calculated as,

DSO = (Average accounts receivable / Annual total sales) * 365 days

= ($30,000 / $210,000) * 365 days

The DSO has gone up to 52 days due to some delinquent customers.

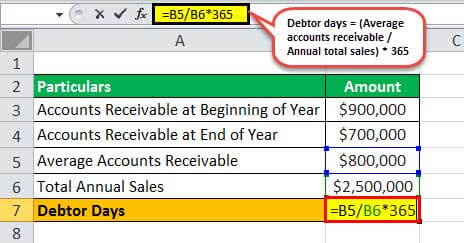

Debtor Days Formula – Example#2

Let us take another example of ABC Ltd that reported a total annual sales of $2,500,000 for the year ending 31st December 2016. The accounts receivable at the beginning of the year was $900,000 and the balance at the year closing is $700,000. Determine the Days Sales Outstanding of ABC Ltd based on the given information.

Given,

- Total annual sales = $2,500,000

- Average accounts receivable = ($900,000 + $700,000) / 2 = $800,000

Below given table shows data for calculation of Debtor Days Ratio of company ABC Ltd.

Therefore, DSO for ABC Ltd can be calculated as,

Days Sales Outstanding = (Average accounts receivable / Annual total sales) * 365 days

= ($800,000 / $2,500,000) * 365 days

Days Sales Outstanding for ABC Ltd will be –

DSO = 116.8 days ~ 117 days

Debtor Days Formula Calculator

You can use these Debtor Days Formula Calculator

| Average Accounts Receivable | |

| Annual Total Sales | |

| Debtor Days Formula = | |

| Debtor Days Formula = |

|

||||||||||

|

Relevance and Use

It is very important for a company, because if the debtor days ratio is increasing beyond the stated trading terms then it can be indicative of the fact that either the company is not able to collect its debts from customers efficiently enough or may be that the terms are being changed to boost sales. A lower debtor day is favorable as it indicates that the company can collect the cash earlier from customers and that the accounts receivables are good which means that it is not required to be written off as bad debts.

On the other hand, if there is an upward trend witnessed in the debtor ratio, then it means that an increasing amount of cash is required in the form of working capital to finance the business which can be a problem for growing businesses. However, it is important to note that the average varies from industry to industry, although most of the business complaint that debtors usually take too long to pay in almost every market.

Nevertheless, Days Sales Outstanding also comes with a set of limitations, such as an analyst should compare it for companies within the same industry. Ideally, if the companies have the same business model and revenue, then a comparison makes more sense.

Recommended Articles

This has been a guide to Debtor Days Formula. Here we discuss how to calculate Debtor Days Ratio and its formula along with practical examples and downloadable excel sheet. You can learn more about accounting from the following articles –

- Definition of Bad Debt Provision

- What is Days Sales Uncollected?

- Days Inventory Outstanding (DIO)

- Days Payable Outstanding (DPO)

- Operating Cycle Formula

- Trade Receivables Meaning

The post Debtor Days Formula appeared first on .